Madison Thibodeau ’21, Managing Editor

Are you struggling with student loan debt? You are not alone. In 2019, the United States student loan debt is approximately at $1.52 trillion dollars. This means that the total United States borrowers with student loan debt is 44.7 million.

This reality of the situation is that there is more student loan debt than credit card debt and automatable loans. The student loan debt is now the second highest consumer debt category. Therefore, student loan debt is behind only mortgage debt. The price of a home is equivalent to a bachelor’s degree diploma.

The common student loan forgiveness programs are Public Service Loan Forgiveness and Teacher Student Loan Forgiveness. However, 99.5% of students who applied for public service loan forgiveness have been rejected. In 2018, The U.S. Department of Education released the latest statistics for public service loan forgiveness.

Approximately, 41,221 student loan borrowers submitted 49,669 applications for public service loan forgiveness. 206 borrowers have collectively received $12.3 million dollars in public service loan forgiveness. This means that public service loan forgiveness is less than 0.5%. Also, Teacher Student Loan Forgiveness gives a maximum forgiveness amount of $5,000 to $17,500 dollars.

This student loan debt has become so crushing that more employers are helping workers. In 2019, about 8% of employers are offering student repayment assistance. It is a small percentage but a growing number of employers are adding programs to help hire and hold the younger generation of workers.

In 2019, more than 42 million student loan borrowers have a total of $100, 000 dollars or less in debt. The largest group of student loan debt is $10,000 to $25,000 dollars for 12.3 million student loan borrowers. More than 2.6 million student loan borrowers have debt greater than $100,000 dollars.

States with larger population tend to higher student loan debt. California, Florida, Texas and New York are among the four highest states from total student loan debt. Pennsylvania is number 6 with 1.6 million student loan borrowers and a student loan balance of $50.3 billion dollars. The average Pennsylvanian student has $36,854 dollars in debt.

The student loan debt crisis is effecting all age groups. Over the past five years, student loan debt balances have grown across each age category. The largest group of student loan borrowers is under 30-years-old at 16.8 million dollars. The 30 to 60+ student loan borrowers make up 28 million dollars.

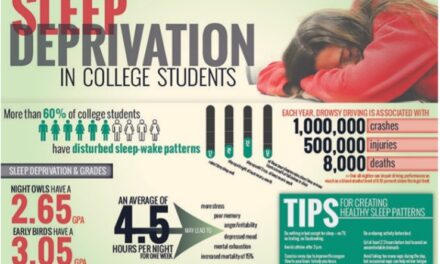

The United States student population attend higher education to obtain a higher paying job. However, the job market is so competitive now that the higher education system is easily accessible. About 69% of high school graduates now go to college. Not only are student graduating with thousands of dollars in debt, students cannot find a job to start paying down those crushing debts.